Under the support of the Chinese government’s plans and policies, the ICT market in China has grown rapidly. By the end of 2014, the country had 630 million Internet users and 1.29 billion mobile phone users.

As one of the most attractive sectors for European SMEs, the EU SME Centre recently published an updated report that offers the latest market insights and practical advice on how to enter the market.

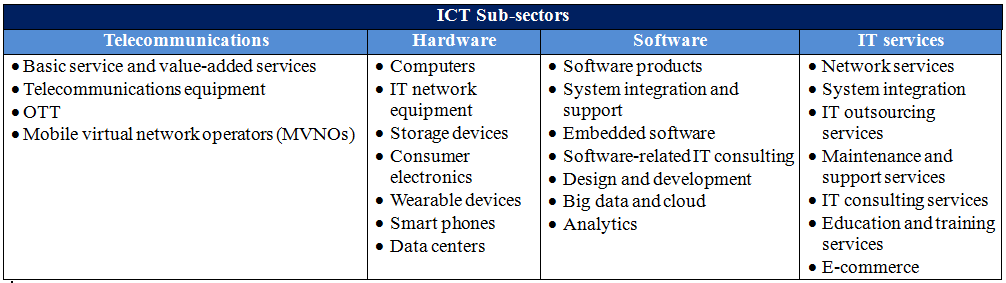

Market Structure

The ICT industry covers a wide range of products and services. The table below provides an overview of the major sub-sectors

Telecommunications

China’s telecommunications industry is dominated by three state-owned enterprises (SOEs): China Mobile, China Unicom, and China Telecom.

China Mobile is the world’s largest mobile phone operator, and at the end of 2014, it had more than 800 million subscribers. China Unicom is China’s second largest mobile phone services and telecommunications provider, and China Telecom is the largest fixed-line services and telecommunications provider in China. Communication equipment manufacturers, such as Huawei and ZTE, are important players in China’s local market.

According to a report from the Ministry of Industry and Information Technology in China (MIIT), the total telecommunication revenue from the three providers was EUR 18.9 billion in January and February 2015, representing a decline in growth. This is largely attributed to the fact that voice and SMS service revenues dropped notably by 15% as a result of apps that provide free messaging services, such as WeChat. Simultaneously, the data flow through 3G/4G is increasing and now represents 25% of total telecommunication revenue.

Hardware

China has become a computer production base in recent decades and is currently regarded as the largest market for computer products in the world. Growing demand from Chinese and international markets has been driving the development of hardware such as computers and mobile phones. Chinese ICT production, including those for export, is mainly concentrated in coastal regions, namely Guangdong, Jiangsu, and Shanghai.

Software

China’s software industry has shown steady progression. In 2014, the total revenue of the software industry in China reached over EUR 560 billion, according to information released by MIIT.

Overall, China’s software market is dominated by local companies, while global software companies currently have an edge in the more high-end software sectors. Local companies are catching up because of the accumulation of experience, increasingly skilled workers, and government support.

IT Services

China’s IT services industry has developed rapidly in the past five years because of growing local demand and government support. According to IBIS World’s estimation in Oct 2014, a market report provider, the IT service industry revenues would reach EUR 104 billion in 2014. Many internet-based IT services, such as mobile apps, e-commerce, online gaming, and cloud computing have become increasingly popular in China.

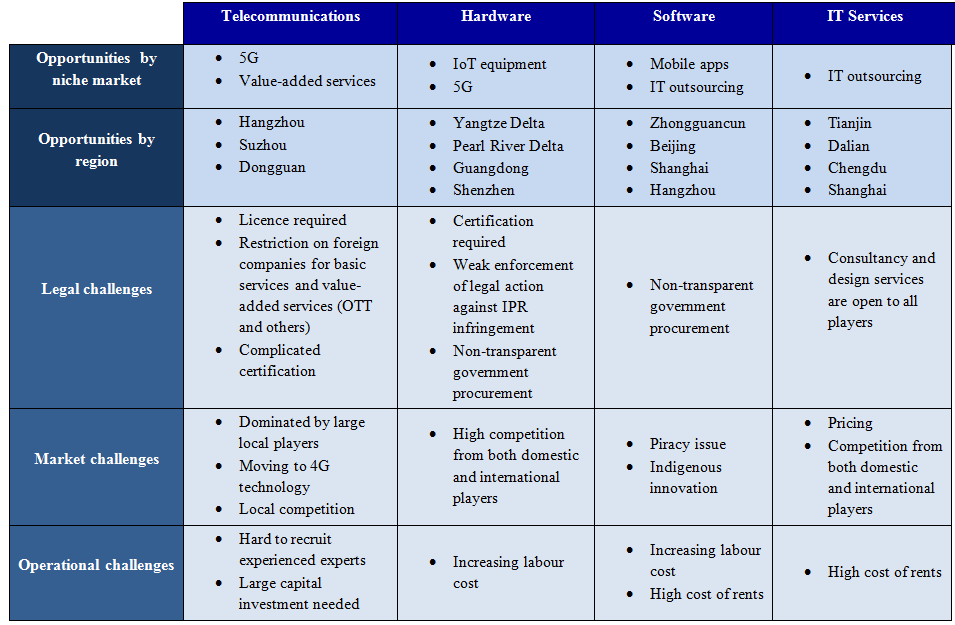

Opportunities and Challenges for SMEs

Advice for SMEs

All things considered, the Chinese ICT market is a challenging arena for European SMEs. However, companies with a thorough knowledge of the market and a good network of local contacts will be able to benefit from China’s digital revolution. Here is a list of advice for SMEs:

- Understand the market: To gain a further understanding of the market, consult experienced support organisations, such as a local chamber of commerce, trade associations, or established consulting firms with local knowledge and proven networks.

- Be present in the market: Visit the country and meet the major market players such as industry associations, potential partners, customers, competitors, investors and research firms, which are vital for long-term business growth in China.

- Focus on a niche market: As the ICT market has an extensive range, focus on specific niche markets that your technologies and products have competitive advantages.

- Build partnerships with local industry leaders: Reliable Chinese partners can provide valuable support in interpreting regulations, understanding market trends and developing business network. Partner with industrial leaders to make suitable investments in terms of future trends for technological developments.

- IP and due diligence: Develop an overall IP strategy covering legal, technical, administrative, and political factors before entering the Chinese market. Meanwhile, find a third party to conduct due diligence investigations when preparing to establish partnerships with local companies.

To learn more about the ICT sector in China, click here to download the Centre’s full report.

If you are looking for practical advice on any issue concerning the development of your business in China, contact the Centre’s in-house experts.

The EU SME Centre in Beijing provides a comprehensive range of hands-on support services to European small and medium-sized enterprises (SMEs), getting them ready to do business in China.

The EU SME Centre in Beijing provides a comprehensive range of hands-on support services to European small and medium-sized enterprises (SMEs), getting them ready to do business in China.

Our team of experts provides advice and support in four areas – business development, law, standards and conformity and human resources. Collaborating with external experts worldwide, the Centre converts valuable knowledge and experience into practical business tools and services easily accessible online. From first-line advice to in-depth technical solutions, we offer services through Knowledge Centre, Advice Centre, Training Centre, SME Advocacy Platform and Hot-Desks.

All services are available on the Centre’s website after registration, please visit: www.eusmecentre.org.cn.