At 5.1%, Romania had the highest growth in the European Union (EU) in 2016, driven primarily by the domestic demand. Over the last 27 years, the country has made considerable progress in developing the institutions for a market economy. Joining the European Union (EU) in 2007 was a driving force for reform and modernization.

Once considered a breadbasket for Europe, agriculture plays an important role in Romania. However the sector requires further development. Romania has the highest proportion of rural population in the EU (45%), the highest incidence of rural poverty (over 70%), and one of the largest gaps in living and social standards between rural and urban areas.

Under the Europe 2020 strategy, Romania has committed to reduce the population at risk of poverty by 580,000 persons and to achieve an employment rate of 70% by 2020. By 2013, only a third of the poverty target had been achieved. One on five Romanians is income poor, and a large share of income poverty is persistent, in that three-quarters of the poor have been poor for at least three years. One-third of the population is severely deprived materially in the sense of not being able to afford items considered to be desirable or even necessary to lead an adequate life. Decreases in the poverty rate pre-2010 reversed in 2010-13, resulting in a marginal decline in poverty of less than 1% between 2008 and 2013.

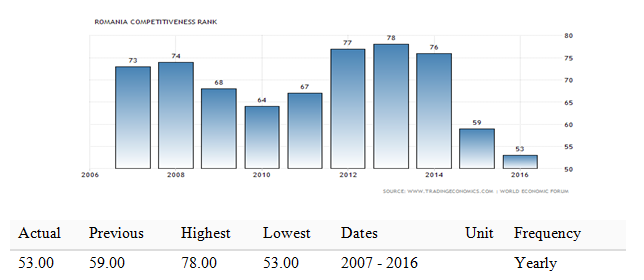

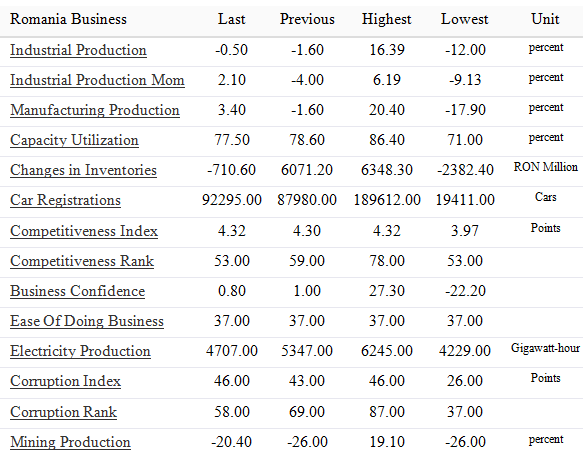

Romania is ranked 53rd in most competitive nation in the world according to 2015-2016 edition of the Global Competitiveness Report published by the World Economic Forum. Competitiveness Rank in Romania averaged 68.90 from 2007 until 2016, reaching an all time peak of 78 in 2013 and a record low of 53 in 2016. Competitiveness Rank in Romania is reported by the World Economic Forum.

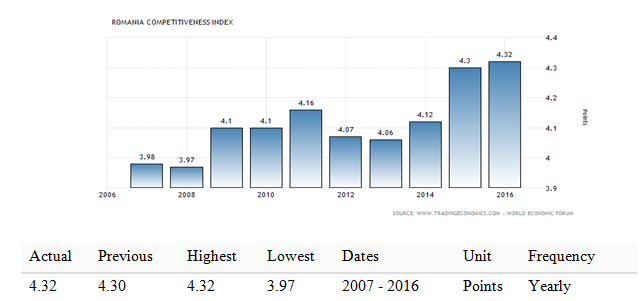

Romania scored 4.32 points out of 7 on the 2015-2016 Global Competitiveness Report published by the World Economic Forum. Competitiveness Index in Romania averaged 4.12 points from 2007 until 2016, reaching an all time high of 4.32 points in 2016 and a record low of 3.97 points in 2008.

The Global Competitiveness Report 2014-2015 edition which assesses 144 economies is made up of over 110 variables, of which two thirds come from the Executive Opinion Survey representing the sample of business leaders, and one third comes from publicly available sources such as the United Nations. The variables are organized into twelve pillars with the most important including: institutions, infrastructure, macroeconomic framework, health and primary education and higher education and training. The GCI score varies between 1 and 7 scale, higher average score means higher degree of competitiveness. This page provides the latest reported value for – Romania Competitiveness Index – plus previous releases, historical high and low, short-term forecast and long-term prediction, economic calendar, survey consensus and news. Romania Competitiveness Index – actual data, historical chart and calendar of releases – was last updated on August of 2016.

Romania is a country of considerable economic potential: over 10 million hectares of agricultural land, diverse energy sources (coal, oil, natural gas, hydro, nuclear and wind), a substantial, if aging, manufacturing base and opportunities for expanded development in tourism on the Black Sea coast and in the mountains. The main industries in Romania are: electric machinery and equipment, textiles and footwear, light machinery and auto assembly, software, mining, timber, construction materials, metallurgy, chemicals, food processing and petroleum refining.

Romania is one of the fastest-growing information technology (IT) markets in Central and Eastern Europe. The country has made significant progress in all of the information and communications technology (ICT) subsectors, including basic telephony, mobile telephony, the Internet and IT. Romania is the leader in Europe, and sixth in the world, in terms of the number of certified IT specialists, with density rates per 1,000 inhabitants greater than in the US or Russia.

Microsoft acquired Romanian Antivirus Technology in 2003. According to Microsoft, Romania has a clear potential in information technology, an area in which Romanian students, researchers and entrepreneurs excel. Its western-oriented culture and the high educational degree of its youth bring Romania forward as a huge potential market (the second largest software producer in Eastern Europe). In terms of IT outsourcing services Romania is ranked in the third place worldwide successfully challenging India.

Romania is ranked 5th in the world in terms of internet connection speed, according to a top made by Akamai. In this ranking Singapore comes out on top (98.5Mbits/s), followed by Hong Kong (92.6Mbits/s), South Korea (79Mbits/s), Kuwait (76.5Mbits/s) and Romania (71.6Mbits/s). The UK comes 27th (51.6Mbits/s) and the US 22nd (53.3Mbits/s).

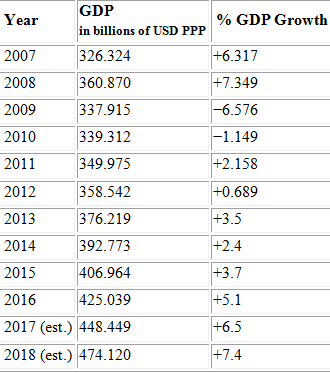

GDP growth reached 8.3% in 2006 according to the statistical office of the Romania (the year-to-year growth amounted to unexpected 9.8% in the 3rd quarter of 2006 and stayed high at 9.5% year-to-year change in the 4th quarter of 2006), and 8.0% in 2007. Table showing selected purchasing power parity GDPs and growth – 2007 to 2018 estimations:

Since Romania joined EU, its GDP have risen with 26%, from 126 billion euro to 160 billion euro. The exports have risen from 29 billion euro to 54 billion euro, taking advantage of one of the four EU’s liberties, free movement of goods. This growth of exports was generated mostly by auto parts and electronics equipment industries. In parallel, exports of services rose with 71% in 2015 compared to 2007, being 16.3 billion euro.

Foreign investments rose from 3.4 billion euro at the end of 2006 to 60 billion euro in 2014, as a result of the free movement of capital.

The medium net salary is 2.051 lei per month (475 euro) in march this year, being twice as it was in 2007, 1.042 lei (312 euro). The growth in lei of this salary was 97%, while in euro this was 46%. In 2007, Romania had 222 km of motorway and in present, there are around 700 km. However, Romania is one of the poorest countries in EU in what concerns the amount of km of motorway, although the budgets for transport were above 20 billion euro in the last 8 years.

In Romania, the public debt rose from 2007 from 76 billion lei (13% of GDP) to 315 billion lei at the end of 2015 (40% of GDP), compared to an increase from 58% to 87% of GDP in EU. In 2016, the debt entered under 40% of GDP, but the situation is very fluid.

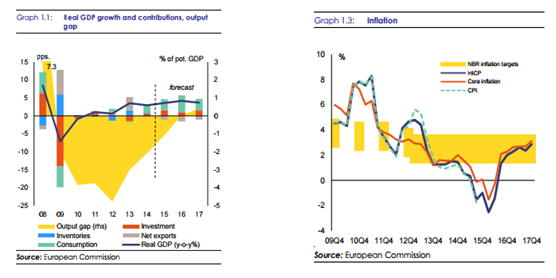

Economic growth in Romania is among the highest in the EU and is forecast to remain above potential in 2016 and 2017. The pace of growth is forecast to accelerate to 4.2% in 2016 in response to the significant fiscal stimulus including tax cuts and increases of the minimum wage and public wages. Economic growth is estimated to moderate somewhat to 3.7% in 2017, but still to remain above potential.

Inflation has been falling in recent years. Annual average inflation has been on a downward trend since 2013 as a consequence of abundant harvests (in 2013 and 2014), falling global oil prices and consecutive reductions in VAT rates for different categories of products and services. In 2015, inflation turned negative after the cut of the VAT rate for all food items and non-alcoholic beverages from 24% to 9% from 1 June (Graph 1.3). In August 2015 inflation recorded a historical low of -1.7% (year-on-year), ending 2015 at an annual average of -0.4%.

Inflation is expected to re-enter the central bank’s target band (2.5%±1 percentage point) by 2017. Inflationary pressures are likely to grow stronger in 2016 with the surge in domestic demand and the increase of the minimum wage from May. The reduction of the standard VAT rate by 4 pps. from January 2016 still works in the opposite direction and annual average inflation is expected to remain negative (-0.2%). However, the output gap is projected to close in the second half of 2016 and the impact of the VAT cuts is set to wear out by the end of the year. Therefore, despite the additional 1 pp. VAT cut envisaged for January 2017, the annual average inflation rate is forecast to reach 2.5% in 2017.

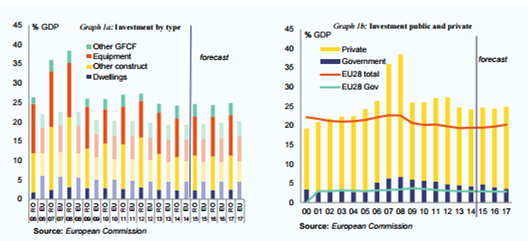

Investment recovered from its drop in 2013 and is expected to sustain high growth rates until 2017. Investment is estimated to have increased by 6.5% in 2015. Private investment is projected to continue growing in 2016 and 2017, albeit at a slower pace than in 2015. Public investment peaked in 2015, but its growth rate is set to slow down in 2016 and 2017.

The main driver is the private sector, whereas public investment still faces serious challenges. The main areas of investment include construction, machinery and transport equipment, while technology and innovation-related investment remains limited. Investment in equipment averaged 11% of GDP in 2000-2014.

The labour market is stable and forecast to improve gradually. Unemployment remained broadly stable at 6.7% in 2015, but is expected to decrease to 6.5% in 2017. Despite employment growth, especially in high value-added sectors, structural problems persist on the labour market. At 17% of the population, the share of young people not in employment, education or training is well above the EU average of 12%.

Romania confronts itself with the migration of a big number of skilled labour in devoped countries of EU, because of a better salary and life conditions. Workers choose to go in another countries to benefit from monetary advantages and employers take Romanian people because they can save costs by paying them less, although this wage is a lot bigger than in Romania. Challenges remain in raising the average skills level of the workforce, addressing the high rate of early school leaving and strengthening the capacity of labour market institutions. Labour market and social challenges are closely related and there are big disparities between rural and urban areas. Romania faces very high risks of poverty, social exclusion, and income inequalities. All these factors weigh on the growth potential of the economy.

Recent developments point to a further decline in the share of foreign currency loans in the portfolios of banks. The share of foreign currency loans in total loans to the private sector went down from roughly 58% in June 2014 to 52.4% in June 2015.

In what concerns the future, the Romanian Government has already focused on developing the welfare of citizens and, as a result, of the country. “Competitive Romania” is a national economic project whose main aim is to converge the GDP level per capita to the one of the European developed countries. This was launched at the beginning of July 2016 and involves measures which would stimulate the economic growth from 3% to 5% as a result of a better management of factors like capital, labour, productivity.

The vision is concretized in 16 domains, such as education, health, agriculture, energy, investments, technology and creative industries, diaspora, European funds. Together with the birth rate, capital market, transport infrastructure, cadastre, research and development, debureaucratisation, public acquisition, accessibility and interconnection, these domains cover 41 priorities and 90 measures with a deadline in 2020.

The human capital is, maybe, the most important pylon for a competitive economy and, because of this, “Competitive Romania” aims to offer quality essential services for the citizens. In what concerns the education, this project aims to decrease the rate of early leaving of schools and increase the rate of youths’ integration in the labour market. The health system wants to reduce the death rate of infants and of people suffering from circulatory system diseases. There are also measures taken to encourage families to have babies by offering some advantages. Financial benefits are also provided to Romanian citizens in order to convince them to come back in Romania.

There is also a willingness to improve the transport infrastructure and to attract more and more investors. In what concerns the infrastructure, the main problems indentified are the lack of a long-term strategy, a poor preparation of projects and the lack of administrative capacity in the Ministry of Transport. In order to improve the actual situation, the Government established some priorities and measures, which include: the selection of the key projects like the nord bypass road of Bucharest, Sibiu-Pitesti route and Tg. Mures-Iasi route, as well as changes in institutions.

After some meetings with more than 100 firms with foreign capital in Romania, the main difficulties discovered in the investment sector are: hard procedures in what concerns state aids, environment authorisations and visa, limited contact with foreign investors at the end of process, weak bonds between local and foreign companies. As a result, the priorities and measures decided include simplification of procedures in different domains (easy ways to get environment authorisations, visa for non-EU citizens, to facilitate labour mobility for expatriates and needed international specialists), state aid acceleration and improvement of its criteria and a better collaboration between public authorities and investors.

This project involves 16 consultations for each domain, in order to consolidate the 90 measures, which can lead to a sustainable economic growth until 2020. The participants of these meetings are specialists in each domain, partners, organisations and other authorised institutions who can form a clear opinion of what should be implemented or not.

To compete successfully, growing the enterprises competitiveness, to innovate, to come up to the requirements of the EU Internal Market are “sine-qua-non” prerequisites which Romania has to meet if it wants to take advantage of its fully-fledged membership in an enlarged Europe.

FLORIN – IOAN ROȘU

Head of Unit, Ministry for Business Environment, Trade and Entrepreneurship, ROMANIA

Founding member of INSME Association and full member of INSME Board (2004-2015).

25 years of Professional experience in business environment and private sector of SMEs development, foreign investments promoting, industrial policy and restructuring, innovation, cooperation and international relations, European economic culture and entrepreneurial education development in Romania.

Member of many professional associations: founding member, in 1990, of the Romanian Management Society, lecturer during 1990s at The Bucharest University of Economic Studies, member of the International Management Foundation, member of The ”Carl Duisberg Romania” Association of Management Specialists. From 1997, vice-president and founder of The Agency for Sustainable Strategies. During 2000-2001, President of the Training Commission ROMPRO. During 2005-2006, personal counsellor of the Deputy Prime Minister for Coordination of Business Environment and SME fields. Starting with 2008, Permanent Representative of Romania to OCDE, ONUDI, UNCTAD, UNECE, ILO, WIPO, UEAPME, WASME. From 2010, Permanent Representative of Romania to the European Commission – DG Enterprise & Industry on “Research for relevant policies for SMEs and Entrepreneurship”.