– by Dr. Alexandra Moritz & Dr. Frank Lang-

Small and medium-sized enterprises (SMEs) are the keystone of the European economy. In 2014, more than 22m companies in the EU were SMEs (more than 99% of all non-financial enterprises). They employed almost 90m people (67% of total employment) and made for 58% of the total added value. Nevertheless, it is more difficult for SMEs to access finance than for larger firms. This is due to a market imperfection in SME financing, which is present on an on-going structural basis. This market deficiency can even be further aggravated in times of a financial and economic crisis (see EIF’s recent European Small Business Finance Outlook here).

The European Investment Fund (EIF) supports Europe’s SMEs by improving their access to finance through a wide range of selected financial intermediaries. For this purpose, the EIF primarily designs, promotes and implements equity and debt financial instruments which specifically target SMEs. In this role, the EIF fosters EU objectives in support of entrepreneurship, growth, innovation, research and development, and employment.

EIF’s Research & Market Analysis team and the Chair of Management at the University of Trier (Germany) have established a research cooperation. This EIF Working Paper is an outcome of this successful collaboration. A follow-on project is already underway. It will build upon the findings of the presented analysis and is financially supported by the EIB Institute under the Knowledge Programme (more details here).

Even though research on SME financing increased over the last years (see for example Beck et al., 2008; Cosh et al., 2009; Chavis et al., 2011), the financing patterns of SMEs in Europe are still not well understood as most research focused on a single financing instrument (e.g., bank loans) and its determinants. But this is unsatisfactory, as the different financing instruments and their determinants cannot be investigated in isolation from each other. Various substitutive and complementary effects exist between them.

The study “Financing patterns of European SMEs – An empirical taxonomy“, written by Alexandra Moritz, Jörn H. Block and Andreas Heinz, and published as EIF Working Paper 2015/30 [more details here] with a preface by Helmut Kraemer-Eis and Frank Lang (EIF Research & Market Analysis), taps into this research gap by taking a more holistic perspective by developing an empirical taxonomy of financing patterns of European SMEs. It uses the firm level data of the ‘Survey on the access to finance of enterprises (SAFE)’, which is jointly conducted by the European Central Bank and the European Commission. The survey is well-suited for the research project as it has information on 14,859 (wave Apr.-Sept. 2013) companies in 37 countries in Europe but with most of the firms questioned in the survey being SMEs (around 90%). Furthermore, the SAFE contains information on a large number of financing instruments. To identify financing patterns of European SMEs the financing instruments are used as active variables in a cluster analysis including 28 European countries and 12,726 SMEs. Afterwards the financing patterns are analyzed according to various passive variables including firm-specific (i.e., firm size, firm age, ownership, growth, and profitability), product-specific (i.e., innovativeness), industry-specific (i.e., main activity), and country-specific (e.g., geography, financial market systems) variables.

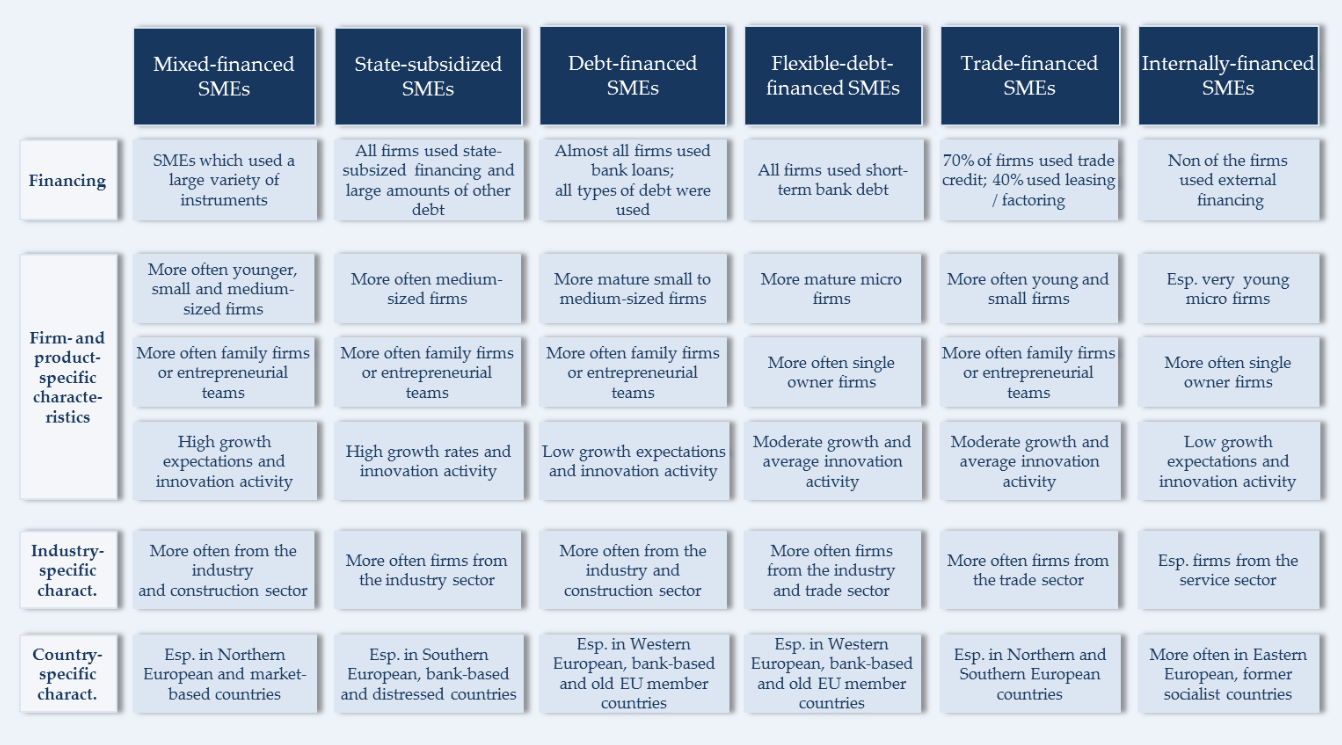

The results of the study demonstrate that SME financing in Europe is not homogenous but that different financing patterns of SMEs exist. Six distinct SME financing types in Europe are identified: mixed-financed SMEs, state-subsidized SMEs, debt-financed SMEs, flexible-debt-financed SMEs, trade-financed SMEs and internally-financed SMEs. These groups of SMEs differ according to the number of different financing instruments used as well as the specific combinations of these instruments. These results indicate that various financing instruments are considered as substitutes and complements in SME financing. Furthermore, the study finds that different financing patterns are determined by various firm-, product-, industry-, and country-specific factors. A short overview of the results is provided by the following figure.

Figure 1: SME financing patterns and their determinants

The results of the study provide valuable insights into how to adapt government support programs to the needs of the SME financing types and to different European countries. In this context, the study gives information about possible effects of policy changes in Europe on SME financing and also indicates which groups of SMEs will be particularly affected by these changes.

The results of the study provide valuable insights into how to adapt government support programs to the needs of the SME financing types and to different European countries. In this context, the study gives information about possible effects of policy changes in Europe on SME financing and also indicates which groups of SMEs will be particularly affected by these changes.

For the complete study please click here.

Dr. Alexandra Moritz finished her dissertation about SME financing and crowdfunding at the University of Trier. She is now working in the banking sector in Luxembourg.

Dr. Frank Lang is Senior Manager at the Research & Market Analysis team of the European Investment Fund (EIF).